It’s often said that 90% of people lose money in the stock market, which leads many to believe that investing is risky or rigged against them. But is this really the case? Let’s take a closer look at the facts.

The Stock Market’s Long-Term Performance

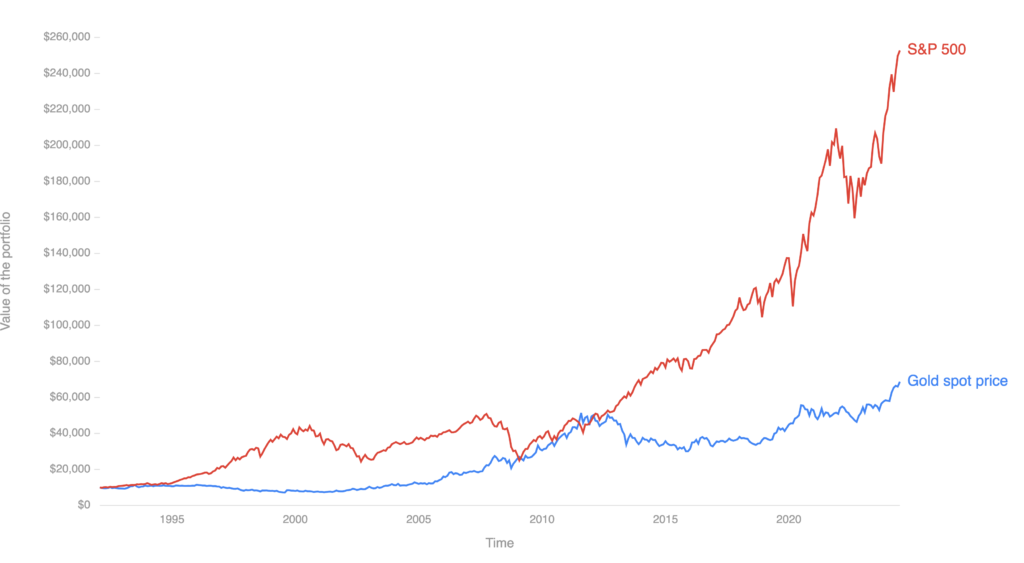

Despite short-term fluctuations, the U.S. stock market has demonstrated a consistent upward trend over the past century. In the last 100 years, out of twelve 10-year periods, 10 showed positive growth. Even major crises like the Great Depression (1930s) and the 2008 Financial Crisis couldn’t stop the market’s long-term rise. The lesson? The stock market rewards patience.

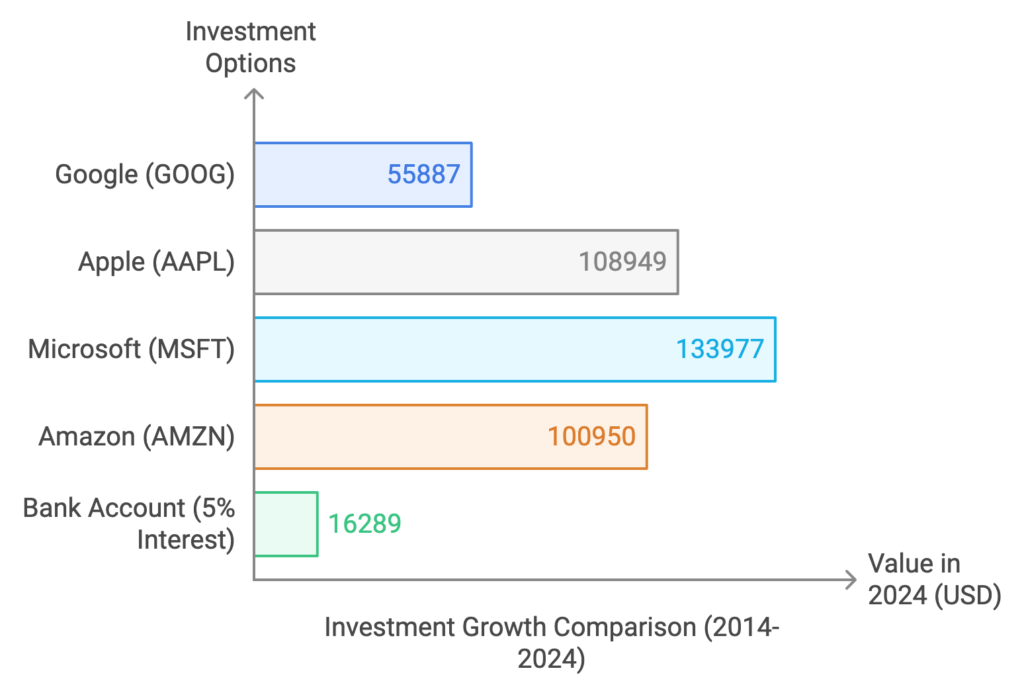

For example, if you invested $10K in solid companies like Google, Apple, Microsoft, or Amazon on Jan 1st, 2014, you would have seen tremendous growth and your investment would now (Apr 1st, 2024) be worth approximately:

- Google (GOOG): $55,887

- Apple (AAPL): $108,949

- Microsoft (MSFT): $133,977

- Amazon (AMZN): $100,950

These are well-known, stable companies—not speculative bets—and they’ve consistently outperformed other types of investments. You don’t need to gamble on risky startups to see good returns. On the other hand, if you had kept your $10,000 in a bank account with an annual interest rate of 5% for 10 years, your total amount today would be approximately $16,289.

This demonstrates the significant difference between stock market growth and traditional savings over the long term.

Why Long-Term Investing Works

One of the keys to stock market success is having a long-term mindset. Legendary investor Warren Buffett once said, “The stock market is a device for transferring money from the impatient to the patient.” It’s important to avoid chasing short-term gains or investing with a “get rich quick” mentality. Instead, focus on steady, reliable growth.

The average annual return of the U.S. stock market over the past century is 10.2%. Even with financial crises factored in, it remains one of the best-performing investment options. For instance, if you invest with an average growth rate of 10% per year:

- In 7 years, your investment would double.

- In 20 years, it would grow 6.7 times.

If the average return rises to 20% (as it did from 2009–2019), your investment could grow 38 times in 20 years. While achieving 20% returns consistently is difficult, the data shows that long-term investors are rewarded.

Avoiding Common Pitfalls

The reason many investors lose money is not because the market is inherently flawed, but because of avoidable mistakes:

- Chasing trends: Many new investors follow hype or buy into unproven companies, hoping for massive gains.

- Lack of discipline: Some investors hold onto losing stocks for too long or sell winning stocks too early, driven by emotions rather than strategy.

- Overreacting to market noise: The stock market can be volatile in the short term, but successful investors stay focused on the long-term outlook.

The best way to minimize risk is to invest in what you know—stick to established companies with proven track records. Even in the worst scenarios, such as the 2008 financial crisis, the market eventually recovered, and long-term investors who stayed patient were rewarded.

Final Thoughts

The stock market offers one of the most reliable ways to grow your wealth over time, provided you have a healthy long-term mindset. By avoiding speculative risks and investing in companies you understand, you can achieve substantial financial growth. The market’s history shows that patience and discipline are key to success.