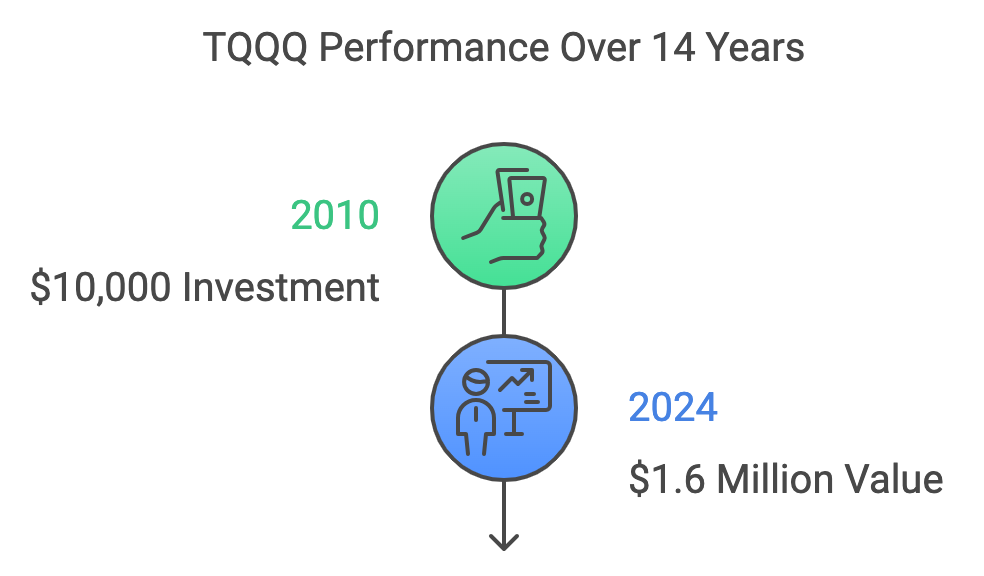

Just finished reading an analysis on TQQQ, one of the most popular ETFs, uses triple leverage to track QQQ. Over the past 14 years, it has weathered multiple bull and bear markets. If you invested $10,000 in 2010, it would be worth $1.6 million today. However, the author is uncertain whether TQQQ can replicate this success over the next 14 years.

The author suggests that the more likely candidate is the small-cap triple-leverage ETF, TNA. The reason is that small caps have underperformed large caps for over a decade, making them relatively cheap. The price-to-book (P/B) ratio is only half that of the S&P 500, and rate cuts are favorable for small-cap stocks, which are often fast-growing businesses.

Do you agree with this analysis? I welcome your thoughts and discussion.